31+ ideal mortgage to income ratio

Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Highest Satisfaction for Mortgage Origination.

Indispensable Real Estate Buyers Agent Checklist For Homebuyers True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

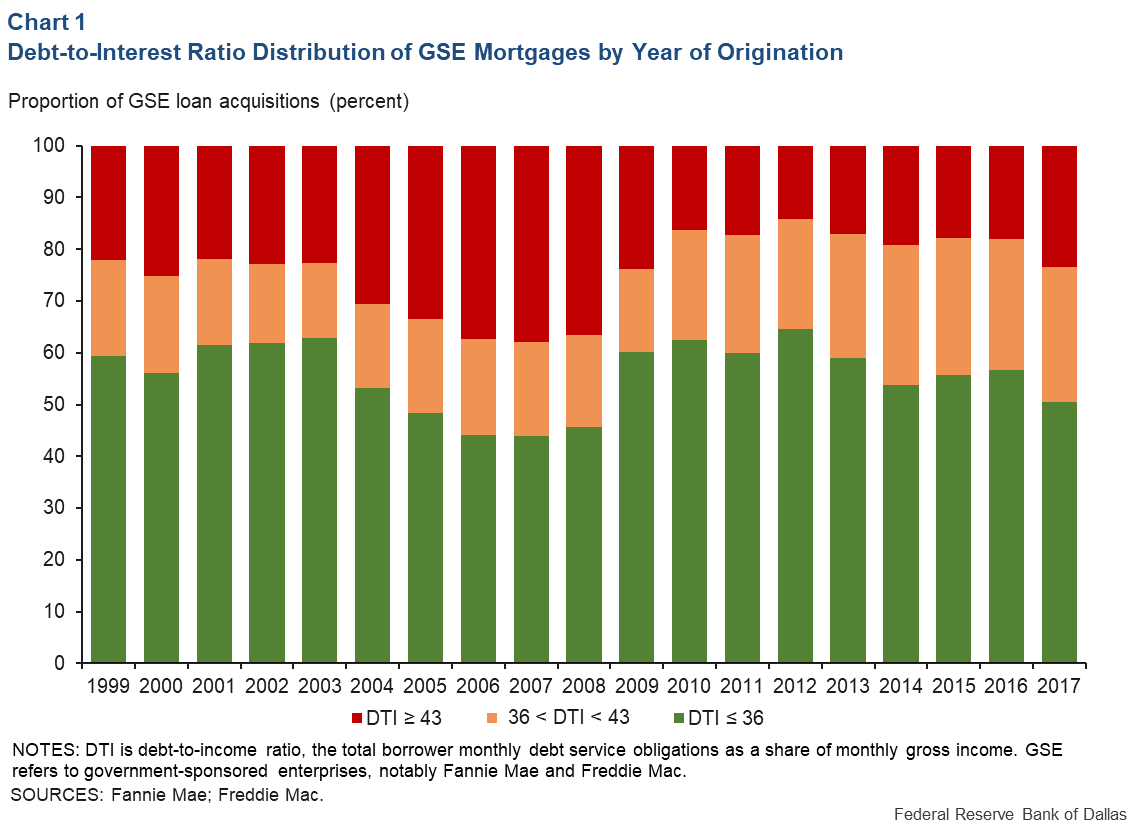

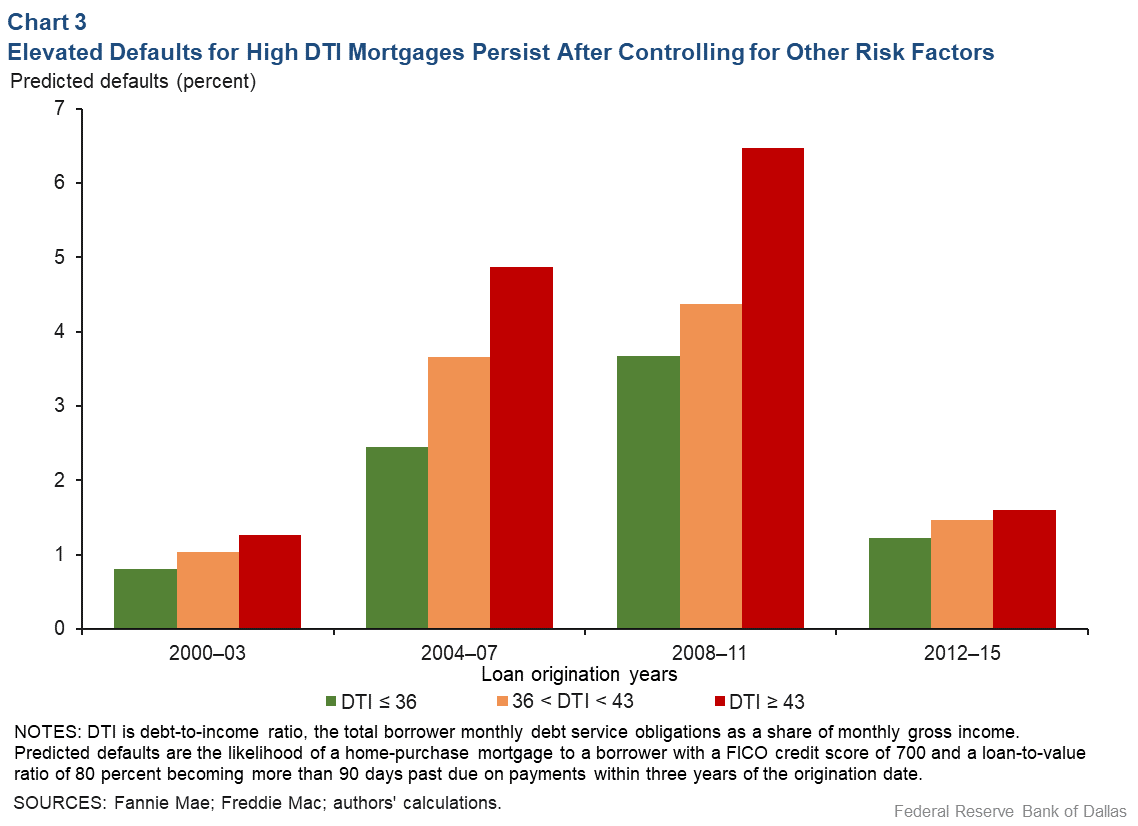

Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage.

. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. 1 2 For example assume. Apply Now With Quicken Loans.

Mortgages Arent Just What We Do. Its Who We Are. Ad Compare More Than Just Rates.

Apply Now With Quicken Loans. Find A Lender That Offers Great Service. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad See what your estimated monthly payment would be with the VA Loan. Its Who We Are. Apply Online To Enjoy A Service.

Find A Lender That Offers Great Service. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

Comparisons Trusted by 55000000. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

If youd put 10 down on a 444444 home your mortgage would be about 400000. Save Real Money Today. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web How much income is needed for a 400K mortgage. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Generally lenders look for a debt-to-income ratio of 43 or less.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Your front-end or household ratio would be 1800 7000 026 or 26. To get the back-end ratio add up your other debts along with your housing expenses.

This means that your. Ad 10 Best House Loan Lenders Compared Reviewed. Debt can be harder to manage if your DTI ratio falls between.

Ad Compare Mortgage Options Calculate Payments. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Lock Your Rate Today. In that case NerdWallet recommends. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments.

Web To calculate your DTI ratio add up your recurring monthly debt payments including credit card student loan mortgage auto loan and other loan payments and divide the sum. Ad Compare More Than Just Rates. Ad Compare Mortgage Options Calculate Payments.

Web This is the amount of debt you have compared to the amount of income you earn. Mortgages Arent Just What We Do.

How Much Of My Income Should Go Towards A Mortgage Payment

Demographic Changes And The Housing Market Sciencedirect

Prosper10k12312010 Htm

Document

Mortgage Brokers South Sydney Located In Rockdale Mortgage Choice

How Much Should My Mortgage Be Compared To My Income

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Prosper10k12312010 Htm

Handbook Final Qxd Securitization Net

Explore The 2020 Wellbeing Sector

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

The Financial Budget Manual By Aginfo Issuu

How Much Of My Income Should Go Towards A Mortgage Payment

How Your Debt To Income Ratio Can Affect Your Mortgage

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Capital Funding 6 Examples Format Pdf Examples